Ultimate Comparison Between 8 Robo Advisor in Malaysia

Welcome to the ultimate robo advisor comparison article! In this article, you will find the best robo advisor in Malaysia that you can use to invest and grow your wealth.

(Spoiler: All of them offer different things, so you will find more than 1 ‘best’ robo advisor in Malaysia here. Happily you can use more than 1 robo advisor)

Let’s start with the players. How many robo advisors in Malaysia are there? Technically there are 8 robo advisors… but I added 2 more.

List of the 8 Robo Advisors in Malaysia (+2 more)

As of July 2024, there are 8 licensed Robo Advisors aka Digital Investment Managers in Malaysia and listed in Securities Commission page. They are:

- AkruNow by Akru Now Sdn. Bhd; The home-grown Malaysian one

- Airo.my by BH Global Fintech Solutions Sdn. Bhd. Seems to partner with Interactive Brokers and Pacific Trustees

- Mytheo by GAX MD Sdn. Bhd.; Malaysian partner of Theo from Japan

- Stashaway by StashAway Malaysia Sdn. Bhd.; expanded from Singapore

- UOBAM Invest by UOB Asset Management (Malaysia) Berhad; ‘robo-advisory for business’. Skip this if you’re managing own funds

- Wahed Invest by Wahed Technologies Sdn. Bhd.; expanded from New York

- Kenanga Digital Investing (KDI) by Kenanga Investment Bank Berhad, the largest independent investment bank in Malaysia

- RIA by Amanah Saham Nasional Berhad; yes, THAT ASNB. They’re known for their fixed funds (ASB, ASM), and now started roboadvisor called RIA featuring portfolios composed of their variable funds

Raiz Invest by Raiz Malaysia SdnBhd; invest-your-spare-change platform. JV between PNB (aka ASNB) and Raiz Invest Australia[Exited MY market July 2024]

In addition to the above, I will add 2 digital investment apps in this robo advisor comparison article.

Not technically robo advisor but might as well be: BEST Invest and Versa Asia

In addition to the 8 robo advisors, I will also include these 2 digital investment apps in this list:

- BEST Invest – they use ‘robo-intelligence’ to select suitable shariah-compliant and ESG unit trusts for you

- Versa Asia – you can use Versa Invest to invest in unit trust, PRS, REITs and gold. They also offer Versa Save, a good place to park your savings

Again, both BEST Invest and Versa Asia are NOT technically classified as Digital Investment Managers and therefore cannot be called robo advisors, but might as well be as the tech used is on par.

Another reason I add them here is because they have 0% sales charge for their unit trusts. Those who buy unit trust will know how rare 0% sales charge is. It can go up to 6%, not including the other fees that you have to pay.

Which robo advisor in Malaysia is the best?

So, which robo advisor in Malaysia is the best? I hate ‘it depends’, so let’s answer it this way: which of the criteria below are the most important to YOU?

- By ROI (return on investment) – which robo advisor has the best returns?

- Lowest Fees – which robo advisor has the lowest fees?

- Global Exposure – which robo advisor offers geographically diverse portfolios?

- Ethical Investing – which robo advisor offers ESG funds?

- Shariah Compliant – which robo advisor can I use as a Muslim?

- Best UI/UX– which robo advisor is easiest to use?

- Home-grown– which robo advisor is made in Malaysia/support Malaysia?

- Technology– which robo advisor offers incorporates the best tech/ offer tech funds?

- Cash Management Accounts – which robo advisor can be used as Savings account/ Fixed deposit alternative?

- Invest in REITs – which robo advisor offers REITs investment?

Pick a number, then go on the sections below to see which robo advisor(s) you should use.

Disclaimer: Do not take the info in this article as financial advice. Use this rob advisor comparison guide to learn, but cross-check with other platforms/parties.

But first, if you’re new to the whole concept – what *is* robo advisor? How do they invest your money?

Let’s cover all that in..

What are robo advisors? What makes it a ‘robo investment’?

Robo advisors, or its technical term, Digital Investment Managers (DIMs) as per the Securities Commission fall under the umbrella of wealthtech services.

The ‘tech’ part is important. Unlike a traditional portfolio manager, robo advisors have streamlined/automated various labour-intensive/mafan parts of investing: the risk profiling, suitability assessment, asset allocation and rebalancing processes.

How your money in Robo Advisor is invested, using the ‘Fruits Basket’ Analogy

Using a robo advisor for investing is similar to buying a fruits basket. You are buying a product which includes a variety of components.

The fruits basket from one robo advisor is not the same as the fruit basket offered at another robo advisor. In fact, the fruits baskets that two people might buy from the same robo advisor might be different too, as we may have different preferences/risk appetites/ financial goals in mind.

What exactly are you buying/investing in? Depends on the fruits basket. Imagine each fruit as a type of asset:

- shares (in different markets/regions/ industries/themes),

- bonds/ sukuk,

- properties/ real estate/ REITs,

- cash/currencies,

- precious metals (gold etc)

- And more

Let’s give a situation for 2 different investors:

- A robo advisor might recommend you a fruits basket containing only bonds and cash, as you informed them (through questionnaires) that you are a super conservative investor.

- The same one might recommend another investor with high risk appetite a fruits basket containing high-growth stocks/index fund in various emerging markets.

What people tend to forget is you can buy a few fruits baskets, for different scenarios. Maybe one is for retirement. Another one earmarked for property ownership. Another one for marriage fund. You don’t have to pick just one.

Is it good to invest with robo advisors?

The short answer is: I think robo advisors are EXCELLENT for investors, including and especially for newbie investors. The entry barrier is ridiculously low. All you need to do is:

- open an account (or a few),

- upload your identification documents,

- add funds into the portfolio recommended for you (guided process), and

- just continue to add funds until you reach your goal(s)

Now let’s go on to dissecting which robo advisor is the best, based on different benchmarks.

#1 – Which robo advisor in Malaysia has the best returns?

Maybe you’re like, Suraya can tell me which robo advisor can give the most profit, the most return on investment? I don’t care about anything else, I just want to get rich fast.

Unfortunately you can’t and shouldn’t do that, because all of the robo advisors can theoretically give you negative or positive double-digit annual return on investment, depending on the state of the economy and the portfolio you pick (recommended to you based on YOUR answers in the risk appetite quiz).

In addition, your behaviour when investing makes a big impact to the returns. Choosing the portfolio which predicts high returns doesn’t matter if you are not suitable for it. If you selected one that is not suitable for your temperament, all you’re going to do is panic sell during bad market conditions.

(And don’t say ‘Oh I won’t one’ – you will. Chances are, you will.)

#2 – Best Roboadvisor in Malaysia: Lowest Fees

Okay, so with that out of the way, maybe you want to concentrate on low fees next.

The fees for all robo advisors in Malaysia are similar; all below 2% per annum. That figure is combined from each robo advisor’s:

- Annual fees* – ranges between 0.2-1% (this is the one listed on their main page), AND/OR

- Annual fund expense – ranges between 0.04-1.8% (this one you have to dig a bit in their FAQs/T&Cs; varies depending on the fund you’re investing in)

Generally speaking, the more funds you deposit in a platform, the less you pay in fees, percentage-wise. (See additional notes on fees below)

However, my view is unless you have six-figures or seven-figures, it doesn’t make sense for you to choose a robo advisor solely based on fees. Other factors are more important.

You can see comparison of robo advisors fees in this iMoney article and at each platforms’ website. But, again, fees aren’t the most important factor.

*Additional notes on fees:

- For Versa Asia‘s Versa REITs specifically, the Annual Management fee is 1.80% p.a

Next is,

#3 – Best Roboadvisor in Malaysia: Global Exposure

Winner: Mytheo, Wahed Invest (US, Global), AkruNow (US, Developed markets, Emerging markets)

Also good: BEST Invest, Stashaway, Versa Asia

If you are looking for global exposure (which you should if your current investments are all Malaysia-focused), then all the options above are good options.

#4- Best Roboadvisor in Malaysia: Ethical Investing

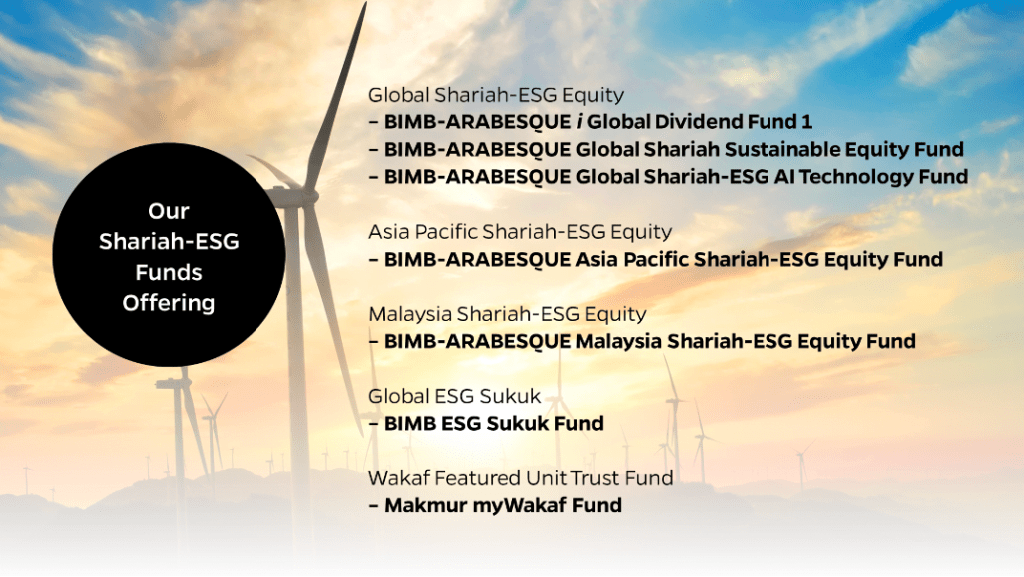

Winner: BEST Invest (all the funds are ESG funds)

Also good: Stashaway (score: ‘ranging between 3.82 and 4.13 out of 5‘), Wahed Invest (no gambling/ alcohol/ firearms etc companies)

Personally, ethical/ESG investing is one of my top criteria in choosing a robo advisor. There are research that links ethical investing to higher profits, too = the perfect two birds one stone situation for me.

Here’s how a sample portfolio might look like (screenshot from BEST Invest):

#5 – Best Roboadvisor in Malaysia: Shariah Compliant

Winners: Wahed Invest, BEST Invest

Also good: RIA by ASNB, Airo (offers Shariah-compliant portfolios), Stashaway (added Shariah Global Portfolios in Aug 2025)

Yes, at writing time, those are the only options for Shariah compliant robo advisor/ investment platform. This list excludes cash management accounts.

Note: I have personally used Wahed Invest for years now and happy with it. If you want to open an account and try Wahed Invest yourself, download the Wahed Invest app from Appstore/iOS and use my referral code ‘surbin1’ to get free RM10 bonus when you deposit RM300. Further reading: The Ultimate Wahed Invest Review

#6 – Best Roboadvisor in Malaysia: UI/UX

Winner: Stashaway, Wahed Invest, Versa Asia

Also good: the rest

Good user interface and user experience isn’t everything, yet very much appreciated.

#7 – Best Robo advisor in Malaysia: Home-grown

Winners: Akrunow, Kenanga’s Digital Investing, RIA by ASNB

Also good: Wahed Invest

- Akrunow is a home-grown startup

- RIA invests in ASNB funds, which includes a lot of blue-chip companies listed in the Malaysian stock exchange

- Kenanga’s Digital Investing is from Kenanga Investment Bank, the largest independent bank in Malaysia

Meanwhile, Wahed Invest includes Malaysia-made ETF in Moderately Conservative portfolio and above.

#sapotlokal

#8 – Best Robo advisor in Malaysia: Technology

Winners: BEST Invest (for using ‘robo-intelligence’), Kenanga’s Digital Investing (for using AI), Stashaway (for their technology-focused thematic portfolios and crypto ETFs), Airo.my (includes Tech ETFs in some portfolios)

Also good: The rest.

Tbh I’m not particularly convinced by AI or robo-intelligence, since it’s only as good as the data you feed them, and human biases in data collection is a well-documented issue.

BUT who am I but a no0b when it comes to technology. Plus thousands of datapoints are factored in, so theoretically that easily beat humans’ capabilities, so take this as an opinion at best.

I do like Stashaway’s thematic portfolios though. It’s like investing in tech startups, I get Silicone Valley vibes. They also offer crypto ETFs.

#9 – Cash Management Accounts (Savings account/ Fixed deposit alternative)

Winners: Kenanga’s Digital Investing (KDI Save), Stashaway (Stashaway Simple), Versa Asia (Versa Save and Save-i)

Also good: Conservative portfolios from the other robo advisors, Touch N Go’s Go+, and BoostMyMoney by Boost

Cash management accounts are accessible accounts that give higher returns than savings accounts (at banks). They are super safe and typically offer around 3.x% annually. Some many offer higher (I’ve seen 4.x%) especially promo.

Please note cash management accounts are NOT investment accounts. They are for people with very low risk appetite and/or looking for places to put money beyond bank accounts. Further reading: 6 Best Savings Accounts in Malaysia to Put Your Emergency Funds

#10 – Invest in REITs

Winners: Wahed Invest (Thematic portfolio > REITs), Versa Asia (Versa REITs).

REITs are Real Estate Investment Trusts. Basically REITs contain portfolios of asset-generating real estate. You can imagine it as: what stocks are to unit trusts, real estate is to REITs.

If you want REITs robo advisor, these two platforms are your only options.

- Wahed Invest offers Shariah-compliant Local REITs, while

- Versa Asia‘s Versa REITs gives you exposure to real estate assets in Singapore, Hong Kong, Malaysia and United States

Here’s how to buy REITs from both platforms.

How to buy Local REITs from Wahed Invest

Here’s the step-by-step process to buy Local REITs from Wahed Invest:

- Open Wahed Invest account (Obligatory referral code: Download app and use code ‘surbin1’ to get FREE RM10 bonus when you deposit RM300 )

- Select Thematic > Local REITs (If you already have existing investment, click Add account in Dashboard)

- Cash in (fund your account) a minimum of RM100 and complete your purchase

- Congrats, you have invested in the REIT 🙂 Repeat the purchase next month, or consistently

How to buy Versa REITs from Versa Asia

Here’s the step-by-step process to buy Versa REITs from Versa Asia:

- Open Versa Asia account (Obligatory referral code: use code ‘SURAYA’ or click here to get FREE RM10 when you deposit RM100 in your account)

- Select Investments > Versa REITs

- Cash in (fund your account) a minimum of RM100 and complete your purchase

- Congrats, you have invested in the REIT 🙂 Repeat the purchase next month, or consistently

Versa REITs gives you exposure to real estate assets in Singapore, Hong Kong, Malaysia and United States.

#11 – Invest in Crypto

Winners: Stashaway

Stashaway is the only one in this category, as they are the only roboadvisor in Malaysia that offer crypto ETFs to their customers. As of writing time, they offer Bitcoin ETF. As per a news article, soon Stashaway will offer Ethereum ETF too.

For someone considering diversifying part of their portfolio in crypto for long term, the fees are not bad.

Robo advisor comparison: Which will you choose?

We have come to the end of this robo advisor comparison article, based on different categories. By now, you should have an idea of which criteria that are most important to you.

If not, go back to the above categories and select a couple of robo advisors based on the criteria that are most important to you (as an example, for me Shariah-compliant robo advisor is non-negotiable).

Check the websites, download the apps and start your investing journey: time in the market > timing the market and all that.

I still don’t know which robo advisor to choose!

If you have a few hundred ringgit or more, it’s not a bad idea to try a few, just to compare between platforms. For example:

- RM100 in robo advisor A (winner of category of your choice)

- RM100 in robo advisor B (winner of category of your choice)

- RM100 in robo advisor C (winner of category of your choice)

If you end up liking one over the other, you can always withdraw and allocate everything in one place. None of them charge withdrawal fees.

Which is better: Versa VS Stashaway?

Okay, let’s say you’ve read everything here and deciding between two platforms: Versa vs Stashaway. Which one should you pick?

Both Versa Asia and Stashaway have:

- Cash Management accounts: Versa Asia has Versa Save; Stashaway has Stashaway Simple

- Investment options from Conservative to Aggressive investors

- New customer benefits: Versa Asia gives FREE RM10 when you deposit RM100 in your account. Simply use code ‘SURAYA’ or click here. Stashaway gives 50% off fees for 6 months if you sign up from here.

However,

Get Versa Asia if you want to invest in unit trust, PRS (great for retirement and can get tax relief), REITs and gold. You can also pick Versa Asia if you want a Shariah-compliant place to park your savings (called Versa Save-i).

Get Stashaway if you like their thematic portfolios and want to invest in technology, consumer tech, healthcare, and environmental industries.

Also choose Stashaway if you want to get crypto ETF.

Which is better: Versa VS KDI (Kenanga Digital Investing)

How about if you’re deciding between two platforms: Versa vs KDI (Kenanga Digital Investing). Which one should you pick?

Both Versa Asia and KDI (Kenanga’s Digital Investing) have:

- Cash Management accounts: Versa Asia has Versa Save; KDI has KDI Save

- Investment options from Conservative to Aggressive investors

- New customer benefits: Versa Asia gives FREE RM10 when you deposit RM100 in your account. Simply use code ‘SURAYA’ or click here. KDI also gives FREE RM10 when you deposit RM250 as a new user. Simply use code ‘110332’ or click here.

However,

Get Versa Asia if you want to invest in unit trust, PRS (great for retirement and can get tax relief), REITs and gold. You can also pick Versa Asia if you want a Shariah-compliant place to park your savings (called Versa Save-i).

Consider KDI if you have less than RM3000 to invest long-term, to take advantage of 0% fees*. Note: Not Shariah-compliant

*That said, I wouldn’t pick it over the 0% fees alone. At RM3000 invested, 0.70% fees is only RM21 per annum. Already cheap. For comparison, many unit trust charges 5% sales fees and 1-2% annual management fee.

With that, I’ll end this guide here. What questions do you have about robo advisors in Malaysia? Which one(s) are you using now, and how are you liking it? I invite you to share your experience investing through robo advisors in the comments section so the rest of us can learn 🙂

![MIDF Invest Review: Buy US Stocks and ETFs from Malaysia Directly, Securely and Cheaply [SPONSORED]](https://i0.wp.com/ringgitohringgit.com/wp-content/uploads/2021/07/midf-invest-review.jpg?fit=768%2C384&ssl=1)

![I Tried BEST Invest by BIMB Investment, the ‘First Robo-Intelligence Shariah ESG Online Investment App’ [SPONSORED]](https://i0.wp.com/ringgitohringgit.com/wp-content/uploads/2020/07/best-invest-bimb-review.jpg?fit=768%2C384&ssl=1)

Hey, I read somewhere that Stashaway Simple is shariah compliant. Is it true?

Hey Ninie,

It used to be, but not any more

hi Suraya! wondering if Akru is shariah-compliant?

Hi Nadia, so far & as of Nov 2021, not yet

Hey! This is a great list. Thanks!!

By the way, the BH Global RoboAdvisor is Airo.

The link : https://www.airo.my/

Thanks Amanda for the info!

Hi,

Anyone can point out which robo advisor or any cash management account platform that can automate / setup recurring direct debit from bank account? Daily RM1.

Trying to “save” RM1 daily to any saving or investment platform.

So far i believe;

StashAway – Monthly (possible to set 4 times/dates so it become per week :D), not sure the lowest amount

Raiz – The lowest amount+frequency is RM5 per week.

Wahed – Monthly? RM100??

KDI – no recurring

MAE Tabung – daily, but the tabung not gaining any interest/profit or not being invested.

Hi Nor,

For daily, the only ones I know is daily gold buys via HelloGold platform via their smartsaver feature and daily bitcoin purchase via Luno platform via repeatbuy feature. Not sure about the rest

I think daily buy is best for assets with fluctuating value. Otherwise if for savings or robo advisor, weekly or even monthly is fine. Not much price difference

Hi Ms Suraya,

Can you review Versa App

Sure, will add soon 🙂

Now Stashaway have Shariah Global Portfolio. Maybe can revisit again?

https://www.stashaway.my/shariah-global-portfolios

Are you from Stashaway haha

Anyway added! Its good news!