[SPONSORED] Verify Touch ‘n Go eWallet & 3 More 5-Minute Security Hacks

Let’s be frank here – ewallet and digital security is not the sexiest of topic to talk about. Therefore, let’s appreciate Touch ‘n Go eWallet not caring to be ‘sexy’ and choosing to feature it anyway in their educational video series, Cashless Confidentials.

In this article, we have brainstormed and came up with 4 actions you can do in 5 minutes that will significantly reduce your risk of losing money from scammers and hackers. It’s fast – you can do everything during lunch break. If you’re busy now, bookmark this article so you can pull it out later.

Note: If you consider yourself a Millennial or Gen Z, what you’re about to read below might sound like common-sense digital security practices.

However, keep in mind that they can be completely alien to your parents and grandparents, who are more susceptible to digital-based scams. I need you to read this so YOU can help them navigate this topic okay.

#1 – Activate Touch ‘n Go eWallet Money-back Guarantee Policy

If you use the Touch ‘n Go eWallet app, this new feature is cooler than it looks. No other ewallets in Malaysia that I know of can give users full compensation for charges made without their knowledge or approval.

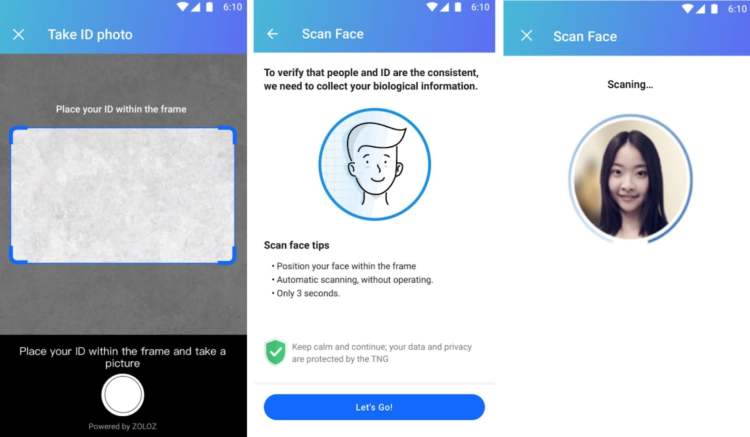

To activate the Money-back Guarantee Policy, you have to verify your Touch ‘n Go eWallet. It’s very quick – see the step-by-step below. You just need an ID and a place with good lighting.

Step 1: Click on the ‘Verify Account Now’ button within your profile page

Step 2: Take a photo of your ID (front and back) through the app. Accepted IDs include: MyKad, MyPolis, MyTentera and Passport

Step 3: Place your ID within the frame and ensure the image is clear.

Note: User can choose to retake or use the photo taken

Step 4: Take a selfie and click on the ‘Let’s Go’ button

Step 5: Take a clear image of yourself

Step 6: Fill in your personal details and click Submit

Step 7: Now that your verification is done. You will need to wait for 48 hours till it gets successfully processed

Check out the videos below for more information about Touch ‘n Go eWallet security, including what you should do if you lost your phone and measures the company use to safeguard your money.

Cashless Confidential Ep 1: Lost phone? Lost eWallet?

Cashless Confidential Ep 3: Cash vs eWallet

#2 – Report weird numbers and emails in your phone as spam

Chances are, you receive spam texts and emails from scammers on a pretty regular basis. After all, according to an investigation by FreeMalaysiaToday, the personal data of 10 million Malaysians – including your MyKad and phone numbers – can be purchased for just RM350.

Unfortunately, there’s not much you can do to stop the texts and emails. Your data is already out there.

But what you can do is report them as spam so they get blocked and don’t get the second chance to connect to you.

Also, read my article on scams. You would think you’re able to identify all emails by scammers. Some of the tactics will surprise you. They’re a creative lot, these scammers.

Cashless Confidential Ep 2: Info phishing is not fishing

#3 – Bookmark all transactional websites

Scam websites are divided into two broad categories: Obviously Scam Websites and Oh My God That Looked Real.

Obviously scam websites:

- Use poor spelling and grammar

- Does not have the padlock symbol next to the website name

- Uses http:// instead of https:// or shttps://

While the ‘oh my God that looked real’ websites look almost identical to who they’re pretending. They use the same wording, the same template and images, the whole nine yards. The lengths scammers go through to deceive you is quite impressive to be honest.

What these scammers really want you to do is to click their link and give them your login IDs and passwords and private information. They’ll tell you many things to get you to click their link – you had an unauthorised transaction, or won a prize, or anything. It might get very tempting sometimes.

You can satisfy your curiosity AND be safe by bookmarking all transactional websites and only going to that website through your bookmarked link (not the one they gave you!). Check la if you did win that car (chances are, you didn’t, sorry).

Bookmarking is easy. I use Google Chrome and all I have to do to bookmark a page is click on the star on the search bar (see upper-right side).

Cashless Confidential Ep 4: Identifying Scam Sites

#4 – Set up VPN and/or Password Managers when you use free wifi zones

Better yet, don’t use free wifi zones. It’s good and all, but you’re also increasing your risk to malwares!

If you *have* to use public wifi, then take the time to activate your VPN service and/or use a password manager. Personally, I use TouchVPN and LastPass respectively.

But generally speaking I just don’t want to take unnecessary risks. Therefore, I’ve limited my public wifi usage to access Google Maps and similar, but avoided using it to login to financial services and make transactions.

Cashless Confidential Ep.5: Free WiFi Zones

Last words

As you and I know, ewallet usage is only going to be more and more normalised in Malaysia. It’s good that Touch ‘n Go eWallet took the initiative to educate on the security aspect. As a regular-ish user of the app myself, I appreciate it.

So far, I’ve used my Touch ‘n Go eWallet to:

- Make payments (especially during the Tealive RM2.50 bubble tea promo. So clever how they appeal to my generation)

- Book movie tickets (they have WeTix integration)

- Link my Touch ‘n Go cards (I’ve lost more than RM100 from previously-lost and unrecorded cards, so this feature is appreciated)

- Get 10×20% toll rebates (use code ‘us5jix’ when you download Touch ‘n Go eWallet app. You and I get 5x more 20% toll rebates!)

While I’ve yet to try:

- Buying prepaid topups and making postpaid payments

- Paying bills

- Making flight bookings (how random)

If there’s one thing to remember from this article, make it this one – do #1 immediately. Verify your Touch ‘n Go eWallet so you get the Money-back Guarantee Policy. It’s free protection against fraud and your LAST layer of defense if your phone was compromised by scammers. I actually did mine in less than 5 minutes.

What other digital security tips you would add on? Share with us in the comments section!

![[SPONSORED] I Asked Hard Questions to the CEO of Funding Societies Malaysia](https://i0.wp.com/ringgitohringgit.com/wp-content/uploads/2019/02/funding-societies-malaysia-1.png?fit=768%2C384&ssl=1)

![30 Healthy Financial Habits You Should Have by 30 [SPONSORED]](https://i0.wp.com/ringgitohringgit.com/wp-content/uploads/2022/07/financial-habits.jpg?fit=768%2C384&ssl=1)

![[SPONSORED] Retirement in Malaysia – Will You Fight or Flight?](https://i0.wp.com/ringgitohringgit.com/wp-content/uploads/2016/10/retirement-in-malaysia-0.jpg?fit=768%2C347&ssl=1)

Uses http:// instead of https:// or shttps:// ← is this typo?

You know, it’s my first time hearing about shttps:// too, but Cashless Confidentials included it so I assumed its a new thing. Isn’t it?

Done suraya. Thank you!

Good job Shamini <3