How Much $$ You Need to Live Well in 2023, According to Belanjawanku 2022-2023

Question: how much money do you actually need, in order to live a good enough life in Malaysia?

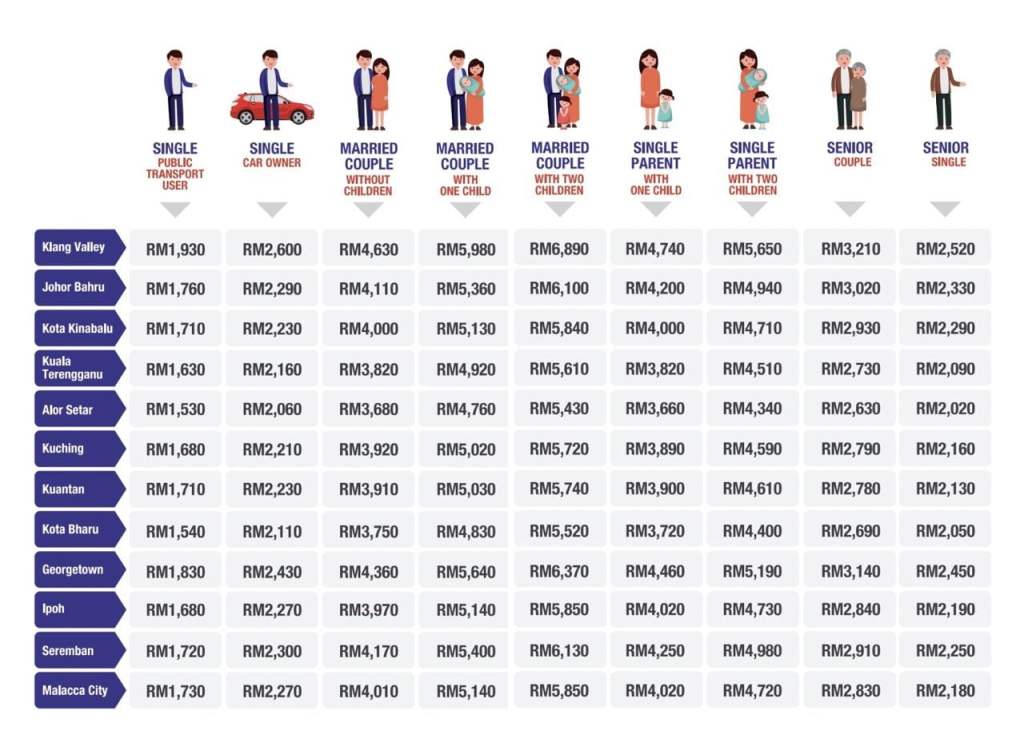

To answer that question, KWSP and Social Wellbeing Research Centre (SWRC) released Belanjawanku 2022-2023 in July 2023, an updated and expanded version of Belanjawanku 2021 and Belanjawanku 2019.

In this article, I’ve compiled the estimated monthly expenses for each household category as included in Belanjawan 2022-2023 Expenditure Guide for your easy household budgeting reference.

What is Belanjawanku

In case you haven’t heard of Belanjawanku, it is an expenditure guide for Malaysian individuals and families aimed to ‘help Malaysians plan their personal and family budgeting to achieve a reasonable standard of living‘.

The bolded part is important. Belanjawanku is not a bare-basics, just enough to eat and sleep kind of expenditure guide. A ‘reasonable standard of living’ is defined as:

- Having enough money to meet basic needs, AND

- Being involved in community activities and gatherings of families and friends, AND

- Living a purposeful and meaningful life

It’s important to note that obviously how much money you need depends on your situation – including your household situation and where you live. Keep the instructions below in mind while you scroll down.

A short note before we start. It is common to, I guess, be angry at the numbers you’re about to see. I’ve seen various versions WHERE TO EVEN FIND CHEAP RENT IN X CITY and ONLY THAT MUCH FOR X CATEGORY?? DO THEY EVEN LIVE IN MALAYSIA on social media.

I don’t know if it will help at all, but I have a short commentary for people who do feel angry at the end of the article. Have a read. But for now, let’s start with..

What’s in Belanjawanku 2022-2023

Belanjawanku 2022-2023 is the latest version of expenditure guide for Malaysians, after Belanjawanku 2021 and Belanjawanku 2019. Here are the household categories and locations

Household categories in Belanjawanku 2022-2023

Belanjawanku 2022-2023 provides budget estimates for 9 household categories:

- Single (Public Transportation User)

- Single (Car owner)

- Married couple (No children)

- Married couple with one child

- Married couple with two children

- Elderly single

- Elderly couple

- Single parent with one child

- Single parent with two children

Locations in Belanjawanku 2022-2023

Belanjawanku 2022-2023 breaks down budget estimates across 12 Malaysian cities:

- Klang Valley

- Alor Setar

- Kota Kinabalu

- Johor Bahru

- Kuala Terengganu

- Kuching

- Kuantan

- Kota Bharu

- Georgetown

- Ipoh

- Seremban

- Melaka

Estimated monthly expenses for each household category, according to Belanjawanku 2022-2023

The households are sorted by: single, married, elderly and single parent, in that order. Find the one that most closely resembles yours.

#1 – Estimated Monthly Expenses for Single, Public Transportation User

The average monthly expense for a single, public transportation user in Malaysia is RM1710. To achieve a reasonable standard of living, they would need a minimum of RM1530 if they live in Alor Setar and RM1930 if they live in Klang Valley.

#2 – Estimated Monthly Expenses for Single, Car Owner

The average monthly expense for a single, car owner in Malaysia is RM2270. To achieve a reasonable standard of living, they would need a minimum of RM2060 if they live in Alor Setar and RM2600 if they live in Klang Valley.

#3 – Estimated Monthly Expenses for Married without children

The average monthly expense for a married couple without children in Malaysia is RM4030. To achieve a reasonable standard of living, they would need a minimum of RM3680 if they live in Alor Setar and RM4630 if they live in Klang Valley.

#4 – Estimated Monthly Expenses for Married with 1 child

The average monthly expense for a married couple with 1 child in Malaysia is RM5190. To achieve a reasonable standard of living, they would need a minimum of RM4760 if they live in Alor Setar and RM5980 if they live in Klang Valley.

#5 – Estimated Monthly Expenses for Married with 2 children

The average monthly expense for a married couple with 2 children in Malaysia is RM5920. To achieve a reasonable standard of living, they would need a minimum of RM5430 if they live in Alor Setar and RM6890 if they live in Klang Valley.

#6 – Estimated Monthly Expenses for Senior Single

The average monthly expense for a senior single in Malaysia is RM2230. To achieve a reasonable standard of living, they would need a minimum of RM2020 if they live in Alor Setar and RM2520 if they live in Klang Valley.

#7 – Estimated Monthly Expenses for Senior Couple

The average monthly expense for a senior couple in Malaysia is RM2880. To achieve a reasonable standard of living, they would need a minimum of RM2630 if they live in Alor Setar and RM3210 if they live in Klang Valley.

#8 – Estimated Monthly Expenses for Single Parent with 1 child

The average monthly expense for a single parent with 1 child in Malaysia is RM4060. To achieve a reasonable standard of living, they would need a minimum of RM3660 if they live in Alor Setar and RM4740 if they live in Klang Valley.

#9 – Estimated Monthly Expenses for Single Parent with 2 children

The average monthly expense for single parent with 2 children in Malaysia is RM4790. To achieve a reasonable standard of living, they would need a minimum of RM4340 if they live in Alor Setar and RM5650 if they live in Klang Valley.

How does your household finances compare to Belanjawanku guide?

How do your household finances compare to the monthly estimates, as outlined in Belanjawanku guide? Are you spending more or less than the average household in your city?

Where can you go from here? Well,

If you are earning more than the monthly estimates and your household expenses are lower than the estimates in Belanjawanku, awesome! You’re in a good situation, keep it up!

If you are earning the same or less than the monthly estimates and your household expenses are higher than the estimates in Belanjawanku, then:

- Look for ways to cut expenses. The top 3 biggest expenses tend to be Accommodation, Transportation and Food so I suggest to start there first. Use my free 50/30/20 Budgeting Template to guide you

- Look for ways to increase your income, because the cost of living is only going to go up from here. Increase your salary through day job or through side hustles

Bonus Section: BUT THE EXPENSES ESTIMATES IN BELANJAWANKU DOES NOT REFLECT *MY* REALITY-

Earlier in the article, I mentioned how some people get angry at the numbers. How come the expenses estimates are much higher than MY expenses, they asked.

Well sorry to break it to you, but just because the data in Belanjawanku doesn’t reflect YOUR reality doesn’t mean the whole thing is wrong. If your expenses are way higher, that probably means:

- you are used to the more expensive version of that category, and/or

- you are unaware of the cheaper options, and/or

- you are unwilling to downgrade your lifestyle.

It’s also possible your situation is different from the basic assumptions the researchers used to estimate monthly expenses across different categories.

After all, Belanjawanku researchers applied several methodologies to come up with the numbers, they didn’t just come out of thin air. You can refer pages 20-41 of the full Belanjawan 2022-2023 Expenditure Guide to learn more.

Could the researchers do better? Sure. Would be great if they add more household variations, or for people with medical conditions. But some data is better than none, and you can always write to them to request nicely instead of YELLING BLOODY MURDER IN SOCIAL MEDIA.

Hope that settles it. If you are still angry, please Google the Main Character Syndrome and see if you have it. I’ll end here.

(Sorry not sorry. Data collection and analysing is a lot of work, and I respect and appreciate the researchers’ effort in doing Belanjawanku. They don’t deserve to be yelled by netizens)

![What You Need to Know About Payment Relief Assistance [SPONSORED]](https://i0.wp.com/ringgitohringgit.com/wp-content/uploads/2021/07/payment-relief-assistance-alliance-bank.jpg?fit=768%2C384&ssl=1)