The Safest Way to Buy a House, Car or Make Other Big Purchases

Every so often, I’d get these types of questions in my DMs:

- Suraya, is now a good time to buy a house?

- Suraya, should I buy a car?

- How much salary to buy a house in Malaysia?

- What kind of car can I buy with RMxk salary?

It always takes me some time to give a comprehensive answer, so I thought might as well write an article about it. Here is the safest way to buy a house, car or make other big purchases. If you satisfy all of the below, chances are you’ll be alright, go ahead and make the purchase.

#1 – You already have enough savings

It’s much safer to make a big financial commitment when you have enough savings than without. How much is ‘enough savings’, though?

It varies from person to person, but I would say, as a guideline,

- A minimum of 6 months worth of savings if employed in stable job

- A minimum of 12 months worth of savings if self-employed with consistent income

- *factor in the cost of monthly instalment/maintenance of the new purchase in your savings calculations

Obviously, the more the better. I would personally feel safer with 24 months of savings.

Next, make sure…

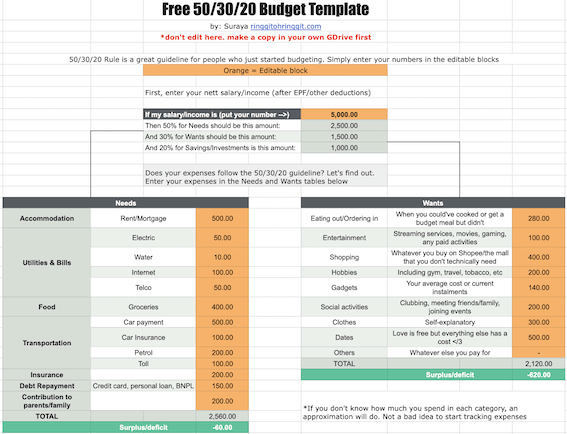

#2 – The monthly payments are well within your 50/30/20 Budget Guideline

Rather than asking yourself how much salary to buy a house in Malaysia, or what kind of car you can get with your salary, you should find out if the instalment amount fits into your Needs category. And you can do this with The 50/30/20 Budget Guideline.

The 50/30/20 Budget Guideline/Rule is basically dividing your income into just 3 major categories:

- 50% for Needs

- 30% for Wants

- 20% for Savings/Investments

If you’re buying a house and/or a car, they should both be included under Needs, because they are Accommodation and Transportation, respectively.

(Here’s everything that usually falls under Needs)

- Accommodation – Mortgage or Rent

- Transportation – A travel pass or vehicle (and all its related costs)

- Food – Groceries and budget meals

- Bills – Electric, Water, Phone, etc

- Debt repayment – credit card, personal loan, BNPL

- Insurance/Medication

- Contribution to Family

Now, let’s say that your income is RM5000 a month. Therefore, 50% for Needs – which combines ALL of the above expenses – should be around RM2500.

That means, if the house or car you’re eyeing costs RM1500 per month in instalments and you’re already spending RM2000 for other Needs-related expenses. This will add up to RM3500 – more than the RM2500 guideline for Needs.

If this is the case, maybe you should continue to live cheaply or look for cheaper modes of transportation for the time being.

Don’t be disappointed if you can’t make the purchase yet. This is just a ‘not yet’, not a ‘cannot ever’. Focus on increasing your income and/or reducing other expenses under Needs and soon enough you’ll be able to afford the accommodation or transportation you want.

Tip: You don’t have to do the calculations yourself. Get the Editable 50/30/20 Rule Template for FREE.

#3 – You have good credit score

Purchase and check your credit score – is it good? The better it is, the better the rates you’ll get. If your credit score is bad, you might want to spend at least 6 months-1 year improving it before making that purchase.

Don’t knock this. For big purchases like a house, even a few 0.x% difference could mean tens of thousands saved in the long run!

You can read about how credit score is calculated and how to improve it in this article.

#4 – You’re not being pushed by salespeople

Some salespeople are super persistent. To earn commission, some try to convince you the purchase is the best idea ever and would even follow up daily. They might even use scarcity tactics to get you to take action, and say things like:

- Not many units left!

- This product very popular, will not last very long!

- The discount ends today!

My belief is, if you are unsure about a big purchase, then it’s a no. So what if you miss this one. Other opportunities will come up (often better ones).

But salespeople are easy – all you have to do is say no firmly and they will usually back off. The next one is harder.

#5 – You’re not being pushed by family/loved ones

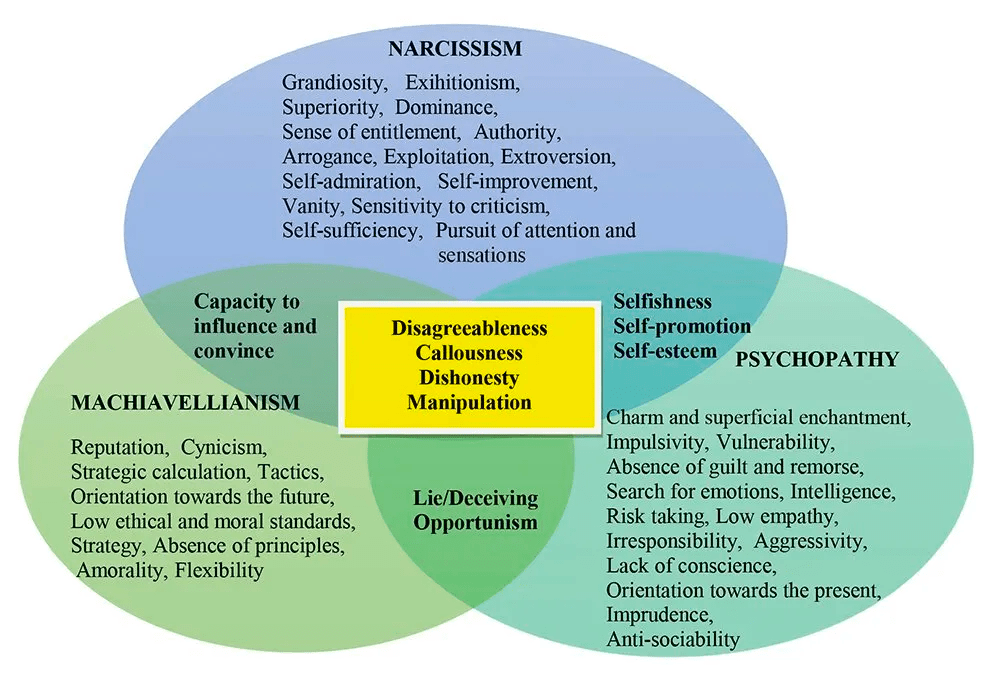

As I mentioned in my 4 TOUGHEST Financial Situations to be in article, some people are unlucky enough to be exposed to Narcissists, Psychopaths and Machiavellians. They are more prone to cheating, manipulating and generally taking advantage of people around them.

That means, these people treat your money (or your credit card, or your ability to take a loan..) as *their* entitlement. They *expect* you to do these things for them.

This is worse if the Narcissists, Psychopaths and Machiavellians are family members, or loved ones. Oh, they would guilt-trip the heck out of you, accuse you don’t love them, accuse you of not ‘paying them back for their sacrifice’, whatever.

Do Not Give In. There is no such thing as ‘just get what they want to make them happy’. No. A core part of their traits is never being satisfied. After you buy that house or that car or whatever, they’ll want something else. So you better nip it in the bud.

Suraya wait, you say, my family/loved ones/friends are not actually Narcissists, Psychopaths and Machiavellians. Actually they have good intentions. They genuinely think a house or a car purchase is a good idea for me. It’s a good investment. I’ll get better opportunities. It’ll improve my life.

Then okay, focus on #1-4. But I would suggest doing what YOU think is right for you, rather than what other people think is right for you. They’re not always right. And if they’re wrong – it’s your name on the lease buddy, not theirs.

That’s it. Now answer yourself – should you make that big purchase?

If you read #1-5 and find yourself saying, yeah I think my finances are good, and this purchase is my own choice. Then go ahead and make the purchase – you’ve done enough due diligence and should be alright. Money is meant to be enjoyed anyway, hoard for what.

Alright that’s all I have for you today. Let me know if you have any questions and all the best 🙂

![6 Things You Should Know Before You Renew Car Insurance in Malaysia [SPONSORED]](https://i0.wp.com/ringgitohringgit.com/wp-content/uploads/2022/04/renew-car-insurance.jpg?fit=768%2C384&ssl=1)