[SPONSORED] The Beginners Guide to Warrants in Malaysia

On 27 April 2019, I attended my first warrants-specific talk.

The event was called Demystifying Structured Warrants, which is apt tbh. I’m a complete beginner in this financial instrument. I know almost nothing about it.

This was my second engagement with the Kenanga Investment Bank, after writing about the Market Outlook Symposium 2019: Smart Investing or Dare Betting? investment event back in January 2019.

I’m happy to report I liked two out of two Kenanga-organised events so far. Good content. No fluff, just lots of good info. Then they gave free food some more.

Like the first article, this is a sponsored post, but all opinions are mine. It’s great that I can share what I learned about warrants from the event, as someone completely new to the world.

#1 – What is warrants?

This is the textbook definition:

Does that make sense to you? I kinda sorta understand… ish. It’s a very theoretical financial instrument. I feel like I’m learning quantum physics.

But for beginners, it’s enough to know that warrants:

- Is a short-term trading instrument

- Uses leverage – it magnifies gains and yes, losses

- Has limited losses, unlimited upside

- Is a type of option issued by Financial Institutions

- Are based on individual shares & indices

- Are traded on Bursa Malaysia

But what’s more important to know is…

#2 – Warrants trading is a higher-risk type of investment

I can’t emphasise this part enough. During the event, the speakers repeated this many times, which I appreciate. Don’t do warrants trading in Malaysia if you’re totally new to investing.

Warrants trading is considered higher-risk because you need to be familiar with both fundamental analysis and technical analysis of the stocks market, said Isabelle Zhen, the speaker at the event and a warrants issuer at Kenanga Group.

Here’s an example, taken from the speaker’s presentation slides. Notice (1) her notes, taken from news sources, financial statements etc (fundamental analysis) and (2) the charts and the colourful lines each represent market movement (technical analysis).

If you’re not familiar with the stocks market at all, then avoid warrants trading for now. It’s not for you, not yet.

But if you’re already a value investor making consistent positive ROI on your stock picks and now itching to learn trading skills to increase your portfolio’s profits, then maybe consider learning it.

Isabelle warns against putting all your investment money ONLY in warrants. Instead, she recommends the 60:40 Weighted Portfolio Strategy.

(It can also be 70:30 or 80:20 or 90:10, depending on your risk appetite).

That means you allocate 60% of your money to buy the stocks you want to purchase and the other 40% to buy the warrants issued for it. Like so:

The above table basically says that if you only buy HIBISCS shares, and the price moved from RM1 to RM1.10, you’ll gain 10% while its warrants equivalent will gain 25% for the same trade. This strategy increases ROI potential while limiting losses.

#3 – There’s a healthy warrants community in Telegram

I was pleasantly surprised to learn from Kenanga’s talk that there’s a big warrants community in Malaysia. And that there’s a growing interest for it.

Isabelle encouraged people interested in warrants trading to join the right warrants trading community. It’s useful because you can observe and learn from other people’s trading strategies and mindset. People share when they enter and exit trades.

You’ll get buy bid promos. You’ll get tips on how to use the live matrix tool better. You may even learn from other people’s mistakes – some people lose a lot of money when they forget to set up stop loss system, or bought put warrants when they should have bought call warrants*!

(*Put warrants and call warrants are opposites of each other)

Here are some Telegram communities you can join:

- Kenanga’s Warrants Trading Ideas – https://t.me/KenangaWarrants

- Kenanga’s Market-Making Hotline (Private Chat) – https://t.me/PRIVATECHAT_KenangaWarrants

- Malaysia Warrants – https://t.me/Malaysiawarrants

- Elliot Wave Technical Analysis – https://t.me/KLSETA

- Kim’s Stockwatch – https://t.me/kimstock

- TradeVSA – https://t.me/tradevsatradingideas

#4 – Who are warrants issuer and what do they do?

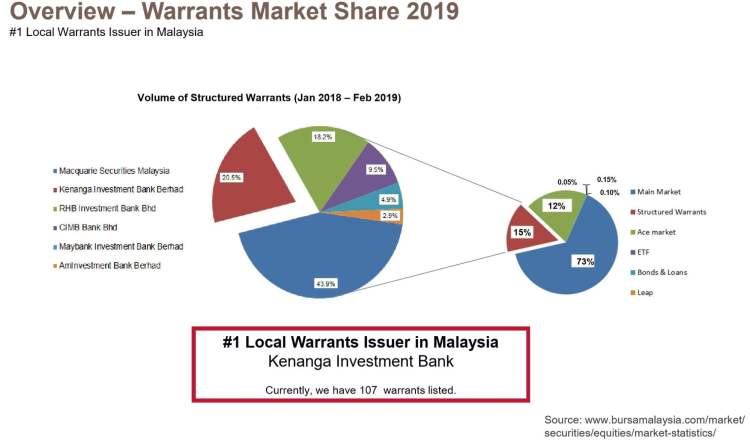

There are 6 warrants issuers in Malaysia. Kenanga Investment is #1 local warrants issuer in Malaysia (Macquarie is from Australia).

Warrants issuers… issue warrants. Like, they’re the ones who choose which blue-chip stocks or indices will be the underlying instrument to the warrant, the ‘mother share’. They need to make use the 6 components to calculate the pricing, then publish the terms of the warrant.

The naming for warrants in Malaysia is straightforward. If the stock is listed as INARI on Bursa Malaysia, the warrants issued will be called INARI-CA (first time listed), INARI-CB (second time), INARI-CZ (26th time), INARI-C1 (27th time listed) and so on.

Warrants issuer make money by (1) something called the time value decay (see image below), (2) hedging and (3) spread between buy/sell. Isabelle said warrants issuers CANNOT make money by manipulating the market, Bursa Malaysia has very clear guidelines on that.

If warrants issuers are caught manipulating the market, they’ll get the other warrant, the one from the police.

#5 – How to choose warrants

So as of 8th May 2019 (YTD), there are 650 active warrants in Malaysia – 553 equity and 977 index warrants. From 39 industries.

How do you pick which one to trade?

This is where it gets interesting. There are advanced tools to use for warrants trading, I had no idea. The one offered by Kenanga is called the Warrant Scanner Tool, following the E.S.T.I Strategy. It’s available at NagaWarrants.com.

The speaker emphasised how you really have to pick issuers that have a Live Matrix. In Malaysia, currently only two out of the six issuers offer has a live matrix tool. Kenanga is one of them.

Last words

Alright, those were some things Kenanga taught me about warrants in Malaysia. I’m not about to explain what is E.S.T.I. Strategy in full or how to use the Live Matrix. To be honest, I’m still wrapping my head around it myself.

The speaker knew that and assured us that warrants trading is an advanced topic. Isabelle actually said:

“I’m happy if you can understand 50% of this talk. And maybe 60% from the next talk, then 70%, and so on.”

Which is quite reassuring tbh. Usually speakers expect you to understand everything, and you feel stupid when you don’t.

If you’re truly new to warrants trading and interested, either buy a book about warrants or buy an online course and learn it yourself, or attend educational talks like this one. I really liked Isabelle’s style of presenting – she knew what terms are confusing for beginners, and included exercises to learn them in the presentation.

Worth repeating: please don’t do warrants trading without learning, because you *will* lose money if you do that.

Isabelle Zhen and her team at NagaWarrants take lunch appointments and hold monthly educational talks about warrants. You can connect with them at 03-2172 2615 during office hours. You can also private chat them via Telegram at https://t.me/NagaWarrants_by_Kenanga (also during office hours).

Some images above came from Kenanga’s free Trading Guide to Structured Warrants ebook. Message Kenanga here to receive a copy.

Any of you do this type of investing? What else can you add about warrants in Malaysia?

![The ‘Just-In-Case’ Things PIDM Plans For [SPONSORED]](https://i0.wp.com/ringgitohringgit.com/wp-content/uploads/2020/11/pidm-function.jpg?fit=768%2C384&ssl=1)

![Why is My Investment Losing Money? 5 Things to Remember [SPONSORED]](https://i0.wp.com/ringgitohringgit.com/wp-content/uploads/2022/08/why-is-my-investment-losing-money.jpg?fit=768%2C384&ssl=1)

![Amanah Saham: 4 Advanced Strategies You Should Know [SPONSORED]](https://i0.wp.com/ringgitohringgit.com/wp-content/uploads/2021/10/amanah-saham.png?fit=768%2C384&ssl=1)

![Check CTOS Credit Report for FREE (+ How to Read, Build and Improve Credit Score) [SPONSORED]](https://i0.wp.com/ringgitohringgit.com/wp-content/uploads/2021/07/check-ctos-credit-score.jpg?fit=768%2C384&ssl=1)