How to Check Unclaimed Money in Malaysia & 14 More To Do If You Need Financial Help

Lots of reasons could have depleted your savings. Maybe you were unlucky and had an emergency. Maybe you lost your job and finding it hard to find another. Maybe someone took advantage of you. Maybe you YOLO’d too hard.

Whatever it is, the financial damage is done. Now how do you get back up again?

I HATE the ‘why didn’t you’-type advice, they’re useless. Instead, here are 15 things you can do to get back on the right financial track.

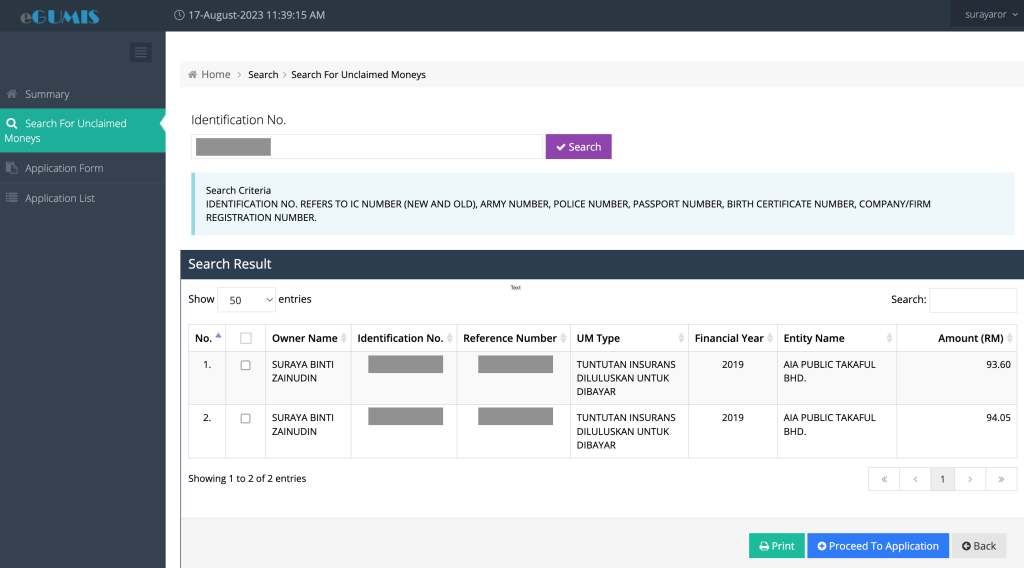

#1 – Check if you have unclaimed money in Malaysia

First, do check if you have unclaimed money in Malaysia. You may have ‘free’ money to claim from the Unclaimed Moneys Registrar. Maybe there isn’t any, but no harm checking – who knows there’s a few thousand ringgit waiting for you, right?

Use these steps to find out if you have unclaimed money in Malaysia:

- Step 1: Go to https://egumis.anm.gov.my/

- Step 2: Complete the online claim application form. Registration info will be sent to your email

- Step 3: Input identification number in the box provided (note: you can only make 2 searches per day)

- Step 4: If there’s unclaimed money, it will show up in the search results (see image below)

- Step 5: To receive your unclaimed money in Malaysia, click on the Proceed to Application button. You are required to input your payee details and upload the relevant supporting documents

IMPORTANT: You must do this yourself, there’s no such thing as paid service or needing someone else doing it on your behalf. As mentioned on the website, ‘Ministry of Finance or the Registrar of Unclaimed Moneys never appoint any individual / firm / company as an intermediary or agent for the refund of Unclaimed Moneys’.

Note 2: If you have parents, help them check if they have unclaimed money as well.

Supporting documents you may need to get your unclaimed money in Malaysia

Depending on the type of unclaimed money you get, you may be required to upload supporting documents:

- Copy of ID card

- Copy of active bank account statement

- Copy of name change documents from JPN – if individual have different name than ID document

- Copy of company name change documents – if company/firm have changed name

- Copy of bank draft/telegraphic form – if apply via TT/bank draft for foreign bank

- Copy of swift code/foreign bank account authentication – if apply via TT/bank draft for foreign bank

- Copy of company liquidation form – by liquidator only

- Copy of minutes/other registration documents – if entity is not registered by CCM/ROS

- Copy of birth certificate – by inheritors (child/parents only)

- Copy of marriage certificate – by inheritors (spouse only)

- Copy of General 80 form and Indemnity bond form UMA-8 – by inheritors for amount under RM2,000

- Copy of Letter of Administration – by inheritors/administrator

- Copy of Letter of Administration (foreign) – by inheritors/administrator

- Copy of proof of payment – done by submission company/firm only

- Copy of claim letter – done by submission company/firm only

- Copy of death certificate – by inheritors (child/parents/spouse only)

You don’t need to upload ALL documents – the platform will tell you which ones are mandatory. For example, I only had to upload (1) and (2).

That should be it. Remember to check once every couple of years or so to see if you have unclaimed money in Malaysia.

For clarifications and questions, you can visit/call the Unclaimed Moneys Registrar office. The address and phone number for Jabatan Akauntan Negara Malaysia/ Accountant General’s Department Of Malaysia is:

- Pendaftar Wang Tak Dituntut Jabatan Akauntan Negara Malaysia (Accountant General’s Department Of Malaysia) Bahagian Pengurusan Wang Tak Dituntut

- Address: Aras 1, Blok Utara, Perbendaharaan 2, No. 7, Persiaran Perdana Presint 2, Kompleks Kementerian Kewangan, Pusat Pentadbiran Kerajaan Persekutuan 62594 Putrajaya

- Phone number: 03-8000 8600 (Talian AM/General Line)

#2 – Check if you are eligible to receive financial help from Malaysian government

Go to MyGovernment > Applying Financial Help page and see if you are eligible to apply and receive financial help from the Malaysian government. There may be financial aid available, especially for:

- Children

- Housewife

- Single mother

- Senior citizen

- the Disabled

#3 – Check with religious bodies

You may be able to get some help from religious bodies, either from your church, temple or even local surau.

I’m not familiar with processes for other religions, but for Muslims, you may be able to get financial or other types of aid from zakat collection bodies. Contact your respective states’ zakat collection bodies for more info.

Zakat collection bodies in Malaysia, according to state:

- Selangor – Lembaga Zakat Selangor

- Wilayah Persekutuan – Pusat Pungutan Zakat MAIWP

- Melaka – Zakat Melaka

- Pahang – Pusat Kutipan Zakat Pahang

- Perlis – MAIPs Zakat

- Johor – Majlis Agama Islam Negeri Johor

- Negeri Sembilan – Portal Pembayaran Zakat Negeri Sembilan

- Perak – Majlis Agama Islam Perak

- Kelantan – Majlis Agama Islam Kelantan

- Terengganu – Majlis Agama Islam Terengganu

- Kedah – Lembaga Zakat Kedah

- Pulau Pinang – Zakat Pulau Pinang

- Sabah – Bahagian Zakat dan Fitrah Majlis Agama Islam Sabah

- Sarawak – Tabung Baitulmal Sarawak

Note: As far as I know, these aids are not fast. You have to register, then they have to vet and perform background check. Regardless, even if you can get a free meal out of them, it helps.

#4 – Get help from WeListenPack

If you truly have no money for immediate needs like food and baby stuff, contact We Listen Malaysia Organisation). They may be able to help.

However, they may or may not be able to help – it’s subject to funds availability. Help your fellow Malaysians by donating at https://marhaen.my/campaign/557 or 552189537243 Maybank (We Listen Malaysia Organisation)

#5 – Sell things of value

This is obvious, but go ahead and sell things you own for immediate cash. For the best chance of selling, list your items on as many platforms as possible, including Carousell, Mudah, Facebook marketplace and more.

Sometimes, we are reluctant to part ways with our items, even though we don’t use it. This is a good time to learn about the endowment effect: ‘the human tendency to attach more value to items we own simply because they belong to us. In other words, once we own something, we value it more.‘

This is not the time to be a hoarder – stuff is just stuff. Plus you can always buy them back when your financial life gets better. (And it will, you hear me? It will).

#6 – Significantly downsize Accommodation, Transportation and Food

Generally speaking, Accommodation, Transportation and Food make up the biggest expenses in most households. If you want to save money, it’s worth starting from here.

Now, there are a lot of cost-saving tips for these three. However, not all of them work for everyone. So what I’m going to do is leave you with the respective articles so you can decide which one will work best for you and your family.

- Accommodation: 5 FREE or Cheap Housing in Malaysia

- Transportation: The Real Answer to ‘How Much Should I Spend On A Car?’

- Food: 5 Things I Did To Reduce My Damn High Groceries Bill

#7 – If you can, work from home (or move near to workplace)

Find WFH jobs or move near to your workplace. Near as in you can walk/cycle/public transport under 20 mins to get to work.

This lifestyle change means:

- You may be able to sell off your car (save at least RM1k++ per month)

- Or downgrade – sell your car on Carsome and get a cheaper one (in both monthly instalment and maintenance cost)

- The time saved from not maintaining the car or stuck in jams = can find extra income and use for meal prepping, thus earning and saving more money

Again, this won’t work for some situations, but if it does, this strategy will save you a shit ton of money + time.

#8 – See if you are eligible for any help from SOCSO/PERKESO

Go to SOCSO/PERKESO website and see if you can receive financial assistance there. As of writing time, there are 3 types of assistance:

- SIP Prihatin 2.0 – Job search allowance

- SIP GIG – financial incentive for new gig workers

- SIP EMP+ – Additional job search allowance

You might also be eligible to get SOCSO Self-Employment Social Security Scheme for 80% or 100% off. More info in the article.

#9 – Collect money owed to you

If friends/family owe you money, this is the time to ‘remind’ them to return it back to you.

If other individuals/companies owe you money, send them reminders and if you have to, submit a small claims procedure to recover sums less than RM5000. This could be for:

- Refund of money paid for defective goods

- Refund of wages/salaries paid for work that has not been carried out;

- Claims for due commissions

- Claims for payment on supplied facilities, rendered services or undertaken repairs.

- And more

Here’s the process to file a small claims procedure in Malaysia, courtesy of AskLegal.my

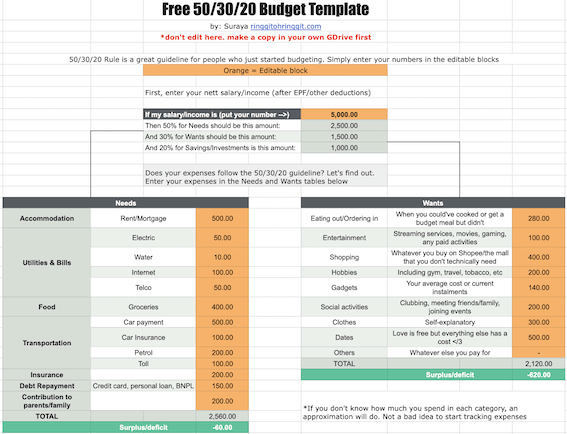

#10 – Do 50/30/20 budget, see how many % is Needs

Needs are:

- Accommodation – Mortgage or Rent

- Transportation – A travel pass or vehicle (and all its related costs)

- Food – Groceries and budget meals

- Bills – Electric, Water, Phone, etc

- Debt repayment – credit card, personal loan, BNPL

- Insurance/Medication

- Contribution to Family

Ideally, these expenses shouldn’t exceed 50% of your take-home salary. The nearer your Needs % are to 100% (or even exceed), the more urgent you have to take action. You can no longer afford to lalala or be in denial about your financial situation.

You can use the free tool in Can You *Really* Afford It? Use the 50/30/20 Rule (Free Editable Template) article to find out your Needs’ %

#11 – Immediately reduce everything under ‘Wants’ category

Your stress and anxiety will make it hard for you to resist Wants or any other impulse purchases. I get it, those purchases can give temporary happiness and sometimes that’s all you want because everything else sucks so bad.

So here I’m going to say, don’t stop spending on Wants, just reduce instead. Like dieting, restricting usually doesn’t work, but giving yourself a small amount to play around with can go a long way.

Give yourself a guilt-free RM50 or RM100 or so (depending on your income) to spend on anything you want. Tell yourself this is your chance to try cheap but fun things you never get to try – like getting that RM1.50 ice cream, instead of RM15 frappuccino.

This will be harder for the natural spenders among you. If you’re finding it hard, know that this is temporary, until your financial life is back on track.

Lifehack: Find low-cost or free leisure activities you enjoy

It would be a problem if you feel like you need to splurge every time you are stressed. Find low-cost or free leisure activities that you can do instead. ‘Reward yourself’ doesn’t have to be expensive.

I compiled what I like to do in my 23 Free/Cheap Things I Do to Stop Online Shopping Habit list. Make your own version, too.

#12 – Consider donating blood

It’s really cool that people who donate blood in Malaysia can enjoy special perks. Here’s the blood donor privilege list, as of 20 July 2020, as taken from the Pusat Perubatan Universiti Malaya website.

As you can see, even donating blood once or twice can give you free* outpatient treatment and medical treatment for 4 months.

| Donation Frequency | Blood Donor Privilege |

|---|---|

| 1 time | Free outpatient treatment and medical treatment (excluding X-ray and surgical charges) and second class wards for a period of * 4 months. |

| 2 times (within 12 months) | Free Hepatitis B preventive injection |

| 2 ~ 5 times | Free outpatient treatment and medical treatment and second class wards for a period of * 4 months. |

| 6 ~ 10 times | Free * 1 year outpatient treatment and second class medical treatment for a * 6 month period. |

| 11 ~ 15 times | Free * 2 year outpatient treatment and medical treatment and second class wards for a * 1 year period. |

| 16 ~ 20 times | Free outpatient treatment and medical treatment and second class wards for a * 2 year period. |

| 21 ~ 30 times | Free outpatient treatment and medical treatment and second class wards for a period of * 3 years. |

| 31 ~ 40 times | Free outpatient treatment and medical treatment and first class wards for a period of * 4 years. |

| 41 ~ 50 times | Free outpatient treatment and medical treatment and first class wards for a period of * 6 years. |

| Over 50 times (for “Whole Blood”) and Over 150 times (for aferesis donors) | Free outpatient treatment and first-class medical treatment and wards for 10 years and second-class wards of life after 10 years in first-class ward. |

Malaysians can now check their blood donor card update and privilege level in the MySejahtera app.

#15 – If you struggle with debt payments, contact AKPK

If you are stressed all the time because of your debt situation, go to https://services.akpk.org.my/EN/ and get the help you need. AKPK’s services are FREE.

#14 – Find extra income

Even if your job pays well, it can be dangerous to rely on one income. Not to make you panic, but lay-offs happens.

So, brainstorm and decide on a type of gig work that you can do – better if it’s something you yourself find fun or at least curious about. Register on gig platforms and if possible, start doing some work if only to collect testimonies. This will help you get jobs easier when you really do need them.

Here are some options:

- Fiverr

- Upwork

- Freelancer

- Goget.my

- Swifty.my

- Thekedua.com

- E-hailing/Food delivery rider – Grab, etc

- Babysitting – Sitly.my, etc

- (Please send more suggestions in the comments section)

Personally, I would focus on the platforms paid in USD because the exchange rate is favourable to Malaysians. But there’s no harm in trying out ALL the gig work platforms. If you’re financially struggling, whichever platform sends (paying) clients your way is the best platform.

#15 – Get my book, Bergaji & Pokai

I wrote Bergaji & Pokai: Membina Kehidupan Bebas Tekanan Melalui Pengurusan Kewangan Yang Realistik especially for people who are stuck in the vicious paycheck-by-paycheck cycle.

You don’t have to get it if the free information on RinggitOhRinggit.com is enough, but if you are overwhelmed, get the book. I’m addressing the one thing most people find challenging – feeling overwhelmed by all the financial info out there, paralysed in fear and stuck in analysis paralysis. You can follow the step-by-step I outlined in the book.

You can get Bergaji & Pokai at bookstores nationwide, or shop online at linktr.ee/surayaror.

What other resources can you suggest to those financially struggling in Malaysia?

I admit, as someone who grew up with more privilege than many others, my knowledge for this article is limited. Regardless, I did my best to compile resources for those who are financially struggling in Malaysia.

It is my hope that readers can (1) add more resources in the comments section, and (2) share this article to people who may need it. If data is to be believed, a lot of people are pretending everything is OK, when they’re actually not.

That’s all from me today. Take care and stay safe y’all. Covid is still around.

![Learn Critical Illness Insurance in 5 Minutes [SPONSORED]](https://i0.wp.com/ringgitohringgit.com/wp-content/uploads/2021/12/critical-illness-insurance.jpg?fit=768%2C384&ssl=1)

![This Income Tax Calculator Shows What You Owe LHDN [2024 Updated]](https://i0.wp.com/ringgitohringgit.com/wp-content/uploads/2021/03/income-tax-calculator-in-malaysia.jpg?fit=768%2C384&ssl=1)

![Check CTOS Credit Report for FREE (+ How to Read, Build and Improve Credit Score) [SPONSORED]](https://i0.wp.com/ringgitohringgit.com/wp-content/uploads/2021/07/check-ctos-credit-score.jpg?fit=768%2C384&ssl=1)

I like about the donate blood thing. But it’s quite far fetched especially to get instant benefit as we need to wait few months for next blood donation. But instant perk is that you will be fed with plenty of food (enough to make you full) immediately after donation if donated directly at Pusat Darah Negara. For booth counters, will be given milo and bun/biscuits only (depend on organizer). However, the instant perks also once every few months though!

True! Unless, you’re planning for free healthcare should one get warded at the General Hospital. I have donated at public hospitals and private hospitals as well. Public hospitals offer donors snacks and bihun, if you’re lucky. Private hospitals sometimes offer grocery vouchers/merchandise/total health screening.

Thanks so much for the info Intan!

Thank you for the info, furaiah!

I tried the e-gumis, but they always say incomplete documents and when I ask the detail of the documents, never get reply after that. Really don’t like with the customer support.

They declined my request, too 🙁 Annoying