My CFP Journey, Part 3: Certificate in Financial Planning CFP Modules 3 & 4

I did it, I passed my CFP exams and ended my CFP journey! I have successfully completed all four CFP Modules and done with this certificate in financial planning!

…But I’m not a Certified Financial Planner, do not offer financial planning services, nor can I take clients. I’ll explain that part in a bit 🙂

This article will be divided into 2 sections:

- Section 1: What I learned in CFP Modules 3 and 4, and

- Section 2: Why passing CFP exams doesn’t mean one is a Certified Financial Planner

Section 1: What I learned in CFP Modules 3 and 4

CFP Module 3 and Module 4 covers Investment Planning and Retirement Planning, and Financial Plan Construction and Professional Responsibilities, respectively. This is how my textbooks look like.

Similar to CFP Modules 1 and 2, I completed all Modules 3 and 4 classes online (instead of in-person), on weekends. Here are the topics covered in each module.

CFP Module 3 – Investment Planning and Retirement Planning

CFP Module 3 – Investment Planning and Retirement Planning contains 13 topics:

- Investment concepts

- Concepts of portfolio theory and performance measures

- Equity investments

- Debt securities investments

- Derivatives and structured products

- Collective investment schemes and unit trusts

- Real estate investments

- The underlying principles of retirement planning

- Investment for retirement

- Retirement schemes

- Employee Provident Fund and Private Retirement Scheme

- Retirement income streams

- Roles of financial planning professionals in pre-retirement counseling

CFP Module 3 was probably the toughest of all CFP modules. There were so many calculations!

Not only you have to learn in-depth about all the different types of investments out there, you also have to learn concepts of portfolio theories, how to measure performance and risk of one’s investment and all that. It was fun, but technical.

The second part of Module 3 on retirement planning contained EVEN MORE calculations. Here’s a typical question:

Newly retired Mr X currently have RMxxxxxx in his retirement account. Assuming Mr X lives to 85 years old and wants to use up all his money, the inflation rate stays at 3% and EPF generates 5% annually, what is the maximum amount that Mr X can withdraw per year?

What if Mr X wants to leave RMxxxxxxx inheritance to his children? How much should he have in his retirement account?

Mr X didn’t have enough money (there’s always a shortfall). What should he do? How much should he add into his retirement account to ensure he has enough to retire?

Yeah. By the end of Module 3, you will have learned know how to calculate all that.

CFP Module 4 – Financial Plan Construction and Professional Responsibilities

CFP Module 4 – Financial Plan Construction and Professional Responsibilities contains (only) 8 topics:

- Financial planning and the rehulatory framework

- Establishing and defining relationship with the client

- Gathering client data

- Analysing and evaluating the client’s financial status

- Developing financial planning recommendations

- Presenting financial planning recommendations

- Implementing financial planning recommendations

- Monitoring financial planning recommendations

CFP Module 4 basically ties in what you have learned in CFP Modules 1-3. Assuming you did your homework, tying everything together wasn’t particularly hard. It’s like putting all the theory into practical. We did cashflow planning, retirement planning, insurance planning and more for hypothetical clients.

However, I noticed some students seemed a bit lost, at least in the beginning. And later I understood why – they were all Challenger* students. They skipped CFP Modules 1-3 and straightaway started at Module 4.

My theory is they didn’t use the formulas on a regular basis in their work, because I see some struggling even with basic calculations that were covered in Modules 1 and 2!

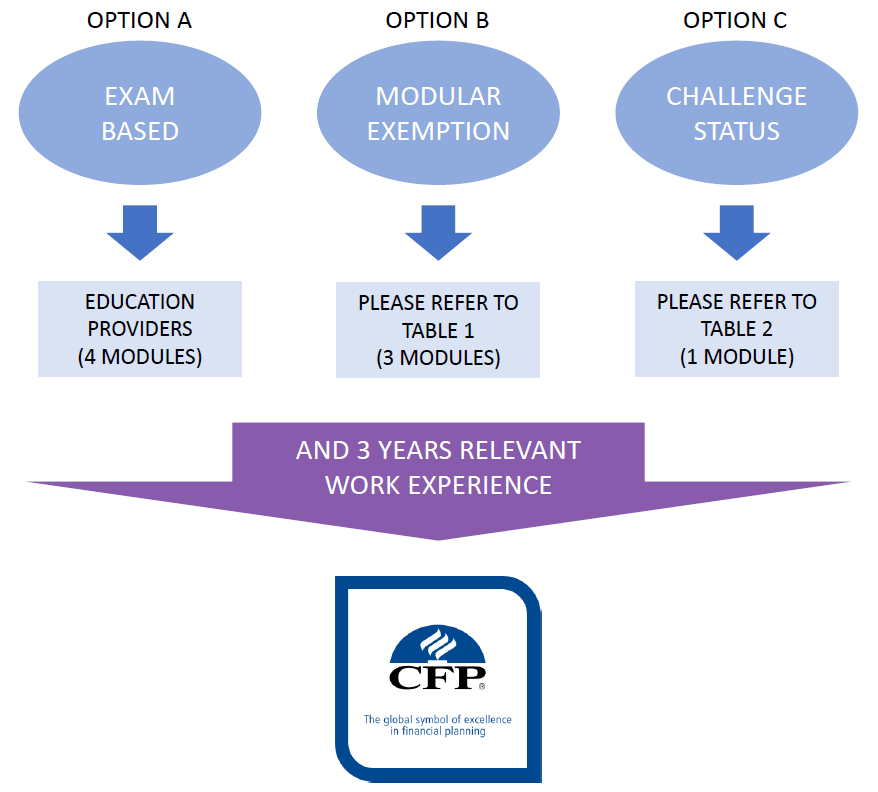

*Only people with relevant experience/backgrounds can apply for Challenger status. Learn more about this in Part 1 of my CFP journey article.

Therefore, if you want to take Challenger Status, it’s not a bad idea to take the add-on classes to brush up on your financial and tax calculations. Some may even do exam bootcamps. Talk to your CFP education provider.

Now that you know what is covered in CFP Modules 3 and 4, I’d like to share this surprising info:

Section 2: Passed CFP exams =/= Certified Financial Planner

You’d think that passing CFP exams would give you the CFP title that you can use in your name, right? Noooooo

Here’s how it works:

- Passed CFP Module 4 + 3 years of relevant work experience + pay annual FPAM membership (RM410 for full year) + collect 20 CE points every year = then only can use Certified Financial Planner title

- Passed at least 1 CFP exam + pay annual FPAM membership (RM150 for full year) + complete 15 CE points every year = then only can use Associate Financial Planner title

How to Collect FPAM CE Points

CE Points, short for Continued Education Points, can be earned by completing these activities:

*This info is accurate as of writing time and taken from this FPAM document.

| Activity | CE Points |

| Attending CE courses conducted by FPAM Secretariat & Chapters | Full Day – 10 Half Day – 5 Tea Time – 2 |

| Writing articles relating to financial planning for FPAM’s 4E Journal *Max 10 CE Points per year | Per article – 5 |

| Contribution of articles representing FPAM to other publications *Max 6 CE Points per year | Per article – 3 |

| Author of published books related to FPAM approved financial planning topics *Max 10 CE Points per year | Per book – 10 |

| Volunteer to assist FPAM Secretariat in organising events (excluding Chapters office bearers) | Per event – 3 |

| Design & development of CFP Certification Program course materials for FPAM’s registered education providers *Max 10 CE Points per year | Per module – 10 |

| Lecturing of CFP Certification Program Modules *Max 10 CE Points per year | Per hour of lecture – 1 |

| Speaker/ Instructor/ Facilitator at: a) CE Workshops b) Financial Literacy Outreach Programs *Max 10 CE Points per year | Per hour of lecture – 1 |

| Design & development of continuing education workshop materials for FPAM’s registered education providers *Max 10 CE Points per year | Per module – 10 |

| FPAM Website Testimonials *1 per member (one-time submission) | 5 |

| Get Magazine Subscriptions: • 4E Journal (token for renewal) • Smart Investor • Money Compass • Islamic Finance News • Business Today | 5 each |

| Get Professional Tools: • PlanPlus • Finametrica • Xpert ePlan | 6 each |

| Membership Renewal a. Auto Debit via Credit/Charge Card only (Visa, Master & Amex) b. Exemplary Bonus | 3 2 |

Therefore, assuming you want to upgrade to Certified Financial Planner status, you’re looking at ~RM1000 in yearly cost just to maintain the title.

But wait. All that is just for the right to use CFP after your name. You can’t actually offer financial planning services. Not yet.

Only CFP title is not enough to offer financial planning services

In order to be a financial planner and advice clients, you must also do 2 additional things:

- Get Capital Markets Services Representative’s Licence (CMSRL) From Securities Commission, and

- Be attached to a financial planning company

*Note: CFP is not the only route to be a financial planner. You can also do the Registered Financial Planner (RFP) route (and maybe some others – comment if you know more info)

For me, I have no plans to offer financial planning services to clients. Also having the CFP title after my name is not that important. It is enough that I took (and passed!) all 4 CFP modules and know the info that I share on Ringgit Oh Ringgit is good, or at least not harmful.

(You’ll see me using any opportunity I can get to brag that I passed CFP though. Let me OK. It cost me almost RM10k, so let me milk it 😂)

Maybe later if I choose to switch career and go into offering financial planning as a service, I’ll do it. But for now, you should know that all certified financial planners in Malaysia go through this super tough process to be in this line of work, so do prioritise their advice rather than weird weird random people on social media*.

*On that note. I believe that EVERYONE can talk about money online. Share away what YOU do with YOUR money. But advising and telling others what to do with their money, where to invest etc? Follow advice from professionals

Should you take this certificate in financial planning to manage your finances better?

Someone asked me, Suraya I want to learn to improve my finances. Should I take CFP?

My personal opinion is… nothing is stopping you, and learning is always good, but it is a bit overkill. Instead of paying CFP course fees to learn money management, following the steps to financial freedom guide to start then hiring a financial planner is enough for most people.

Thus concludes my CFP journey, this article is the last one in the series 🙂 Let me know if you have any questions about getting this certificate in financial planning. You can also learn more by clicking the links below:

- My CFP Journey, Part 1: Why, Where and How Much to Be A Certified Financial Planner in Malaysia, and

- My CFP Journey, Part 2: What I Learned in CFP Malaysia Module 1 & 2

Lastly, thank you to everyone who helped and gave advice long the way, you rock!

![[Personal] 5 Things I Learned in my 20s: Advice I’d Give to My Younger Self](https://i0.wp.com/ringgitohringgit.com/wp-content/uploads/2019/12/advice-to-my-younger-self.jpg?fit=768%2C384&ssl=1)

![[PERSONAL] How I Get Great Clients Who Pay & Treat Me Well](https://i0.wp.com/ringgitohringgit.com/wp-content/uploads/2019/08/great-clients.jpg?fit=768%2C384&ssl=1)

![My 20-year Personal Finance Journey [PERSONAL]](https://i0.wp.com/ringgitohringgit.com/wp-content/uploads/2025/04/personal-finance-journey.jpg?fit=768%2C384&ssl=1)

![[Personal] How it feels like to constantly obsess over money](https://i0.wp.com/ringgitohringgit.com/wp-content/uploads/2016/09/obsess-over-money.png?fit=560%2C315&ssl=1)

Hi Suraya ! Another informative article! Thank you! I have a questions, do you have an updated list of financial books? Locally-relatable books would be good too.

Thanks!

Hi Lee,

Honestly, I’ve since learned that the best way to find books is to go to the bookstore and get the one that looks most interesting to you. It’s the delivery style that’ll make a difference and that’s different for everyone

hello suraya! im interested in the CFP books themselves! can i borrow it from you?

Hi Shamini, the books will stay with me for life 🙂

Can you buy the CFP books even if you aren’t taking the course and exams?

I don’t know, but I don’t recommend it, its very dry and meant to be supplementary to lecturer’s classes. You’re better off buying financial planning or money management books. Cheaper and easier to digest.

Hi Suraya,

Where can I buy the textbooks? I’m determined to go through them because I am a dry and boring person 😀

LMAOOO

You know, a few people have asked me where to get them and tbh, I have no idea where, I got mine from the education provider. Perhaps can try find at Carousell or make a ‘Searching for’ post there?

I’d like to ask, on the topic of 3 years relevant work experience.

Does working as a finance executive in a non-insurance/asset planning company count towards the 3 years?

Hi Gary,

No harm asking FPAM if can be exempted. If you can make a good case that you know most of the relevant subject, then why not.