3 Things to Know Before Buying A House in Malaysia (Don’t Make A HUGE Mistake!)

Read this article until the end before buying a house in Malaysia. You will find out what you ACTUALLY want vs what property ads tell you you’ll want.

Buying a house in Malaysia: What you ACTUALLY want

I’d like to introduce to you one of my favourite books, New Aging: Live Smarter Now to Live Better Forever by Matthias Hollwich with Bruce Mau Design.

New Aging: Live Smarter Now to Live Better Forever is a guidebook to optimising how we live; how to design our lifestyle so that we encourage lifelong happiness, productivity and self-development.

The book gave lots of suggestions on living arrangements – the subject of this post. As someone who have been tempted by property ads featuring unique features (I’m sure you have been tempted by them too), but with something as expensive as a house, rationality should overcome emotions.

So here’s what the book says about where you live – hopefully it’ll guide you when buying a house in Malaysia, and you’ll end up with property which optimises your happiness.

#1 – No matter where you live, make it easy to meet friends and family

Life is all about human connections, isn’t it? Beyond everything else, this is priority number 1. When you’re looking for a place, you want to make sure your dream house is near and accessible to friends and family.

Note: This is especially important for men, who are more likely to suffer from loneliness as they age.

Some suggestions from the book:

- Move closer to family members and friends

- Treat best friends like family

- Integrate colleagues and acquaintances into inner circle (note: personality fit is important too, obviously)

- Greet neighbours and people at places you frequently go to

- Add at least one unique and fun amenity that will reward those who visit (ie: pool, wifi, big kitchen, playroom)

- Live with housemates (and be open about diversity)

Some people told me that they plan to retire in cheaper areas in Malaysia, because the cost of living and property prices there are lower.

But in my case, that’s not an option at all. I know I need to be based in Klang Valley – all my family and friends are here. I need to be near them for a happier life.

#2 – Make it easy to incorporate, access and do activities that provide mental and physical stimulation

Essentially, your home should not, by design, prevent you from exercising your brain muscles and body muscles.

That means it must not be too far from the amenities you need, and must have enough room so you can work on your hobbies comfortably. For example., it would suck if you LOVE going to the gym but live like 1 hour away from it!

Having tried out a few types of living arrangements, I can say that my favourite types of places to live are anywhere that is:

- Walking distance to amenities. For example, somewhere within walking distance to commercial areas, where I can get my groceries and services easily.

- Permaculture-centered communes. I’ve done short stints in France and Australia and love the focus on sustainability.

Your situation and priority might be different. For example,

- my parents are fairly religious, so living near the neighbourhood surau makes them happy

- If you love tinkering with cars, ideally your home should have the space for it (ie a garage)

This segment is simple enough, right? Do more things that you love and are good for you = happier you. Make that easy by designing your home and lifestyle around it.

Last but not least,

#3 – Ageing-related enhancements to your home

I used to fear the ageing process (as we all), but this book helped me reframe that thinking, and even develop a positive attitude towards it.

I particularly love this page. It says, ‘There are no “old people” in the world. There’s only you and me a few years from now’. Don’t Discriminate Against Yourself.

Alright. Point #1 is about living near family and friends, and Point #2 tells you to indulge in hobbies (in or nearby). What next to look for when buying a house in Malaysia?

Accessibility. Something *I* personally have not considered up until recently. I’m lucky that I can move about now, but what happens when I lose my mobility?

That, for me, is the scariest part about ageing. Loss of mobility. The need to depend on others to take care of even the most basic of tasks. I can’t imagine the grief I’ll surely feel towards the loss of freedom and independence.

I have friends who had a taste of this when they lost their mobility due to accidents. None of them told me it was fun.

Suggestions from the book:

- Hire a contractor to add handrails, doorpulls, etc in every room

- Walk around your home with a rolling suitcase to see where navigational challenge might appear. Add ramps where needed

- Have a guest room, so you have the option of having someone over when you really need their help

- Have enough obstacle-free paths in your home – for wheelchair

- Smart-homing everything. Make use of apps that can help you adjust temperature, lighting, security, things like that

In Malaysia, finding property designed with accessibility in mind seems… hard. I don’t think I have a choice but to make and pay for the enhancements myself out of pocket.

Buying a house in Malaysia that fits all criteria may be expensive

I’m not going to pretend that the dream house you envisioned – a house that fits all the criterias outlined above – may be expensive. Perhaps you, like me, will decide that you want to stay in Klang Valley/cities as well.

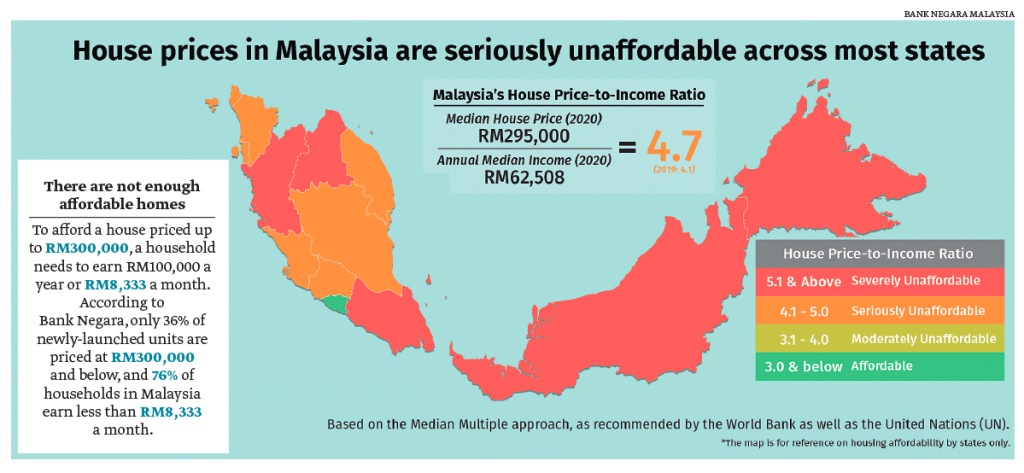

There is also that simple fact that the majority of house prices in Malaysia fall under ‘seriously unaffordable’ and ‘severely unaffordable’ categories.

But here’s the thing on buying a house in Malaysia: I can skimp on many things, but I don’t want to skimp on housing. If I’m going to make the biggest purchase of my life, I want to make sure I’m damn well happy with it.

So, what options do I have if you don’t have that much money? Five possible options I can think of:

5 Options If You Can’t Afford Buying a House in Malaysia Now

Here’s everything one can do if they can’t afford buying a house in Malaysia now:

- Buy an affordable home and forgo some ‘wants’. Read more in 10 Affordable Homes in Malaysia to Check Out if You Earn Average Income article

- Combine income with a partner. Why not submit joint loan application with a partner? However, some may advise against this, especially for Muslims. Especially with the way faraid law (Islamic inheritance law) works, it would get too messy if anything happens to one of us.

- Buy an awesome house with some friends. 6 friends pooled their money together and bought a $1.3 million house in Toronto. According to the article, they knew they couldn’t afford to buy properties they love on their own, so they decided to do it together.

- Start my own intentional community. I’ve subscribed to Intentional Communities for some time now, they give great newsletters and resources. I keep looking out for communities based in Malaysia but alas, no luck yet. Maybe some of you want to take a look and start one?

- Rent until you can comfortably afford to buy. This is what I did. Read more in the The Safest Way to Buy a House, Car or Make Other Big Purchases article

The last one was the choice I ultimately made. The way I see it, if I can rent a good enough place that makes me happy for cheaper than what it would cost to buy, and invest the difference while focusing on making more money (easier without the stress of homeownership), then this becomes a no-brainer decision.

The thing is, I don’t have a ‘must buy property before age X’ goal (perfectly acceptable goal, just not for me). And the bottom line is I want to comfortably afford the mortgage payment before buying a house in Malaysia, because I don’t want to turn something I love into something I hate.

I admit I experienced FOMO once in a while, seeing peers my age buying their first properties in their 20s. But I do not regret waiting one bit. In fact, I’m so glad I waited. I have the money to pay the mortgage, AND I even have savings to do (affordable) renovation, plus we bought new furniture and appliances as well.

Related: Breakdown of My RM57k House Renovation + Makeover Guys Review

What is your thoughts on buying a house in Malaysia?

Tell me – what kind of home and living arrangement you’re hoping for? What is your must-have, and what is optional? Do you plan to save up for your dream home, or go for something cheaper, or try out an unconventional solution?

Let me know in the comments!

![[SPONSORED] What Does PIDM Do and Why Should YOU Care?](https://i0.wp.com/ringgitohringgit.com/wp-content/uploads/2018/09/pidm.png?fit=768%2C384&ssl=1)

Nice article Suraya. My ultimate dream house (when I’ve finally attained my financial freedom) is a cabin in the woods somewhere in Alaska and spend the rest of my life chopping firewood & hunting game.

Hi StazOne,

I have to admit that sounds romantic. All the best!

Good one Suraya. What are your thoughts on the government’s Rumah WIP projects? Would you want to buy one for the lower cost and for potential after 10 year investment?

Hi M,

I don’t think any of them are at commercial areas? My impression is they’re far away. Could be wrong, didn’t look too deep into it. Are you considering them now?

Hi M,

I think most rumawip projects are built at locations which are highly accessible and near to commercial areas. For instance, there is one project being built in Bukit Bintang area and another one near LRT Taman Melati.

I bought one apartment under the project and I’m currently staying there. There is a new MRT station being built within walking distance from my place and it is highly accessible to highways and about 10 minutes by car to commercial areas and the nearest LRT stations in the vicinity.

Hi Muhammad,

Thanks for sharing. Your location and amenities sound amazing. What’s the name of the apartment you bought?

Co-living sounds like a very good concept, especially for singles like me who is not looking to get married or settled anytime soon.

Hi Fatimah,

It’s appealing kan? Who knows we might be neighbours one day 🙂

Bought a condo and it’s right opposite a mall. Love it. Easy to grocery shop, sometimes balik and lupa beli one crucial ingredients – it’s easy for one of us just to walk out and to the store again. Our gym is there as well and it’s less obstacles to working out (used to be lazy to drive, pay for parking etc). If there’s less options in GrabFood due to peak hours, can just walk and eat at a restaurant if really too lazy to cook. There’s pharmacy as well and Mr. DIY as well as one of those RM2 shops. House was RM500k, renovation+new furniture/appliances cost us about RM100k. You can always renovate slowly to fit your dreams/requirement. I don’t think it’ll reach RM1mill lah.

Hahahah you know what they say, better overbudget than underbudget hahah