Link Roundup #79: 10 Things to Know This Week

Accelerate your personal finance knowledge with this regular feature on Ringgit Oh Ringgit – the Link Roundup! I promise you’ll find these 10 links informational 🙂

1. New Harvard Data (Accidentally) Reveal How Lockdowns Crushed the Working Class While Leaving Elites Unscathed. – Foundation for Economic Education

“A new data analysis from Harvard University, Brown University, and the Bill and Melinda Gates Foundation calculates how different employment levels have been impacted during the pandemic to date. The findings reveal that government lockdown orders devastated workers at the bottom of the financial food chain but left the upper-tier actually better off.”

We already know this, but look at the chart, the numbers. Earning for people with low wage declined 23.6%, while earning for people with high wage increased by 2.4%.

What would you do, now that you know this information?

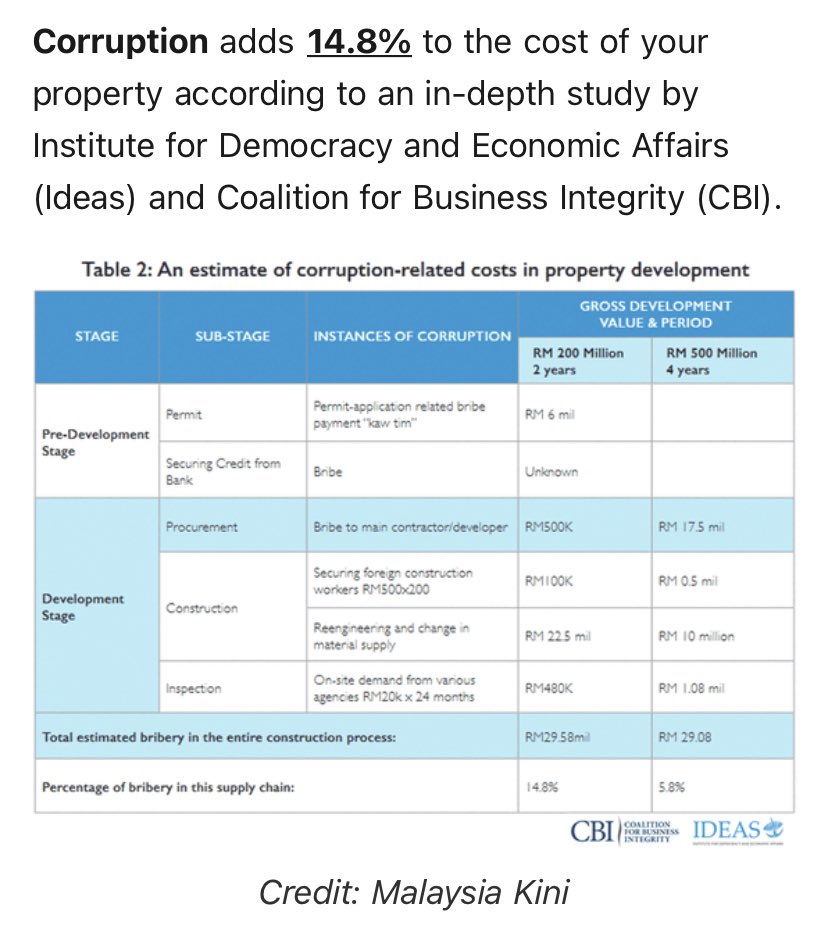

2. Corruption in the Supply Chain: Forms and Impact to Consumers – IDEAS Malaysia

So this study by IDEAS found that corruption adds 14.8% to the cost of your property. To put into context, 14.8% is equivalent to RM74k for a RM500k house.

I did the calculation. With 3.75% interest rate, 10% downpayment, and 35 years term, the difference between paying for a RM500k house (with corruption) and RM426k house (without corruption) is RM1925 vs RM1640.

I’m angry. You should be too.

3. Some Chinese shun grueling careers for ‘low-desire life’ – APNews

This is such a fascinating piece because in China, the act of not working as hard as possible and being anti-materialistic is considered rebellious behaviour. The Communist Party hates it. They even have a term for it – ‘lying flat’.

“Struggle itself is a kind of happiness,” the newspaper Southern Daily, published by the party, said in a commentary. “Choosing to ‘lie flat’ in the face of pressure is not only unjust but also shameful.”

Just. Wow.

4. This Is What Self-Care Actually Is—and What It Isn’t – Real Simple

“Don’t mistake self-care for overindulgence or expensive luxuries.”

THAT QUOTE THO. I love it. I HATE how big companies are capitalising on self-care, using advertising that hurts your self-confidence then present their products as solutions.

5. ‘If you earn $200,000 or less,’ use the 1% spending rule to save money, says finance expert—here’s how it works – CNBC

‘If you want to spend on something — a non-necessity — that costs or exceeds 1% of your annual gross income, you must wait one day before buying.’

Pfft. Amateur. If non-essential, for anything over RM20, I wait for weeks, months, years. One day, pfft.

Done humble brag.

6. How to be the type of listener everyone wants to be (there are 5) – Ladders

‘You must be a good listener’ – OK… how? Communication is more important than ever nowadays. Those who master it will go far.

This article broke down the five types of listeners:

- Ethical listeners

- Active listeners

- Passive listener

- Evaluative listeners

- Comprehensive listeners

Click the link above to learn the difference between them.

7. Try this simple tool to gauge your happiness and figure out how to improve it – Fast Company

Work is not the key to happiness, yet we’re working more.. in a study commissioned last year, 5,000 people across Australia, the United States, Japan, France, and Germany felt pretty mediocre about work despite no longer having to commute to offices. A huge time savings, yet nearly half said they had less time for personal pursuits. In other words, all the things that really make us happy.

Damn I did not expect an article to attack me this violently.

Anyway, this article introduced me to Personal Moral Inventory – a way to score your happiness. It’s simple – rate and give yourself a score of -1, 0 or 1 on these four categories:

- Productivity and Profit

- People

- Planet

- Purpose

For example, this is how I would rate myself..

- Productivity and Profit – 1 – I’m financially stable and I think I have a good work/life balance (integration?)

- People – 0 – I’ve been told that I’m useful. But I am still fairly selfish and not quite selfless, so I’ll score myself a neutral zero

- Planet – 0 – I can be better at using less, and recycling/reusing more. Also since the pandemic, I’m making more online purchases = extra packaging going straight to the landfill

- Purpose – 1 – I’m proud to be one of the few personal finance bloggers in Malaysia who combine activism into personal finance. Gender equality and wealth inequality are topics I cover a lot

My score: 2.

So, how about you? How would you rate yourself? Learn more about the Personal Moral Inventory and watch the TED Talk in the links given.

8. Are Buy Now Pay Later Schemes Evil? – Fintech News

I was invited to a panel to discuss BNPL.

My commentary – I think BNPL does more harm than good. The only way you can justify BNPL usage is if it’s used for health or safety-related purposes, but BNPL is currently mostly promoted for consumer goods. There is even one BNPL that exclusively partnered with a luxury brand group!

You have to remember that BNPL’s target audience is the consumer debt market – ie the people who are used to financing their lifestyle with debt, or want to, if given the chance. And when you combine that with Malaysians’ generally low levels of financial literacy, and high household debt levels, and salaries not increasing, I don’t see how it can be a sustainable practice for the long term.

Click the link above to watch the whole 1-hour webinar, for commentaries from Hoolah, GHL and Episode 6.

9. 6 Challenges to Buy Now, Pay Later (BNPL) Providers in Malaysia – The Personal Finance Challenge

Very happy to know that I’m not the only personal finance content creator in Malaysia who is actively speaking out against BNPL. Ruiz of The Personal Finance Challenge has outlined six challenges, which the BNPL service providers ignored when tagged.

Here are the challenges. Watch the video for more nuance.

- Challenge #1 – How can you claim that BNPL is beneficial for the average consumer when your business model intrinsically works against customers?

- Challenge #2 – With a business model that naturaly hikes up prices for the end-customers, how is BNPL exactly helping consumers?

- Challenge #3 – Why should consumers choose to use BNPL instead of credit cards, when it does not contribute to a good credit score?

- Challenge #4 – How are you making sure that your customers are actually financially qualified and knowledgable to use BNPL service responsibly?

- Challenge #5 – How do you justify BNPL’s psychology trickery that preys on human weakness?

- Challenge #6 – How do you justify that BNPL is ethical? And for Malaysia, how do you make it shariah-compliant?

(Suraya’s note: There’s actually one BNPL service provider in Malaysia that labelled itself as Shariah-compliant. I’m meh about it, so not going to say who, you can Google yourself, but I like that it implies the other BNPL service providers are NOT Shariah-compliant. That’s good lol).

10. 5 Ways People Are Dumb With Money – Two Cents

And finally. For those of you who think you’re SO rational with money, for people who think you’re exempt from making bad financial decisions. Please. You’re same like the rest of us. We’re all done stupid, irrational things with our money. Marketers know this and have exploited the shit out of it.

Learn about the Endowment Effect, Sunk-Cost Fallacy, Transactional Utility and more ways you’re dumb with money in this video.

—

That’s it for this round, catch you next time! Want to submit a link you thought was great? Reach out to me on FB or Twitter.

To read past link roundups, please click here.